See This Report about Feie Calculator

Table of ContentsThe 45-Second Trick For Feie CalculatorWhat Does Feie Calculator Mean?Feie Calculator Things To Know Before You BuyThe 9-Minute Rule for Feie CalculatorWhat Does Feie Calculator Mean?Rumored Buzz on Feie CalculatorSome Known Details About Feie Calculator

As a whole, united state citizens or irreversible lawful homeowners living abroad are qualified to declare the exclusion. The amount of the exemption is changed every year based on the price of inflation. The amount of exemption for existing and previous tax years is as follows:2015: $100,8002014: $99,2002013: $97,6002012: $95,100 Along with this income exemption, the taxpayer may likewise qualify to omit the worth of employer-provided meals, accommodations and particular edge advantages.To start with, federal government workers are commonly disqualified for the international earnings exemption also if they are living and functioning in a foreign country. A two year-old D (https://louisbarnes09.wixsite.com/feie-calculator).C. Circuit Court choice, Rogers v. Commissioner, may put the value of the foreign income exclusion in risk for thousands of expatriates. Rogers included a UNITED STATE

The Best Strategy To Use For Feie Calculator

The very same regulation would use to someone who services a ship in international waters.

The Foreign Earned Revenue Exclusion (FEIE) enables certifying U.S. taxpayers to omit approximately $130,000 of foreign-earned income from united state government revenue tax (2025 ). For several expatriates and remote workers, FEIEs can mean considerable savings on united state tax obligations as foreign-earned revenue can be subject to double taxes. FEIE works by omitting foreign-earned revenue approximately a specific limitation.

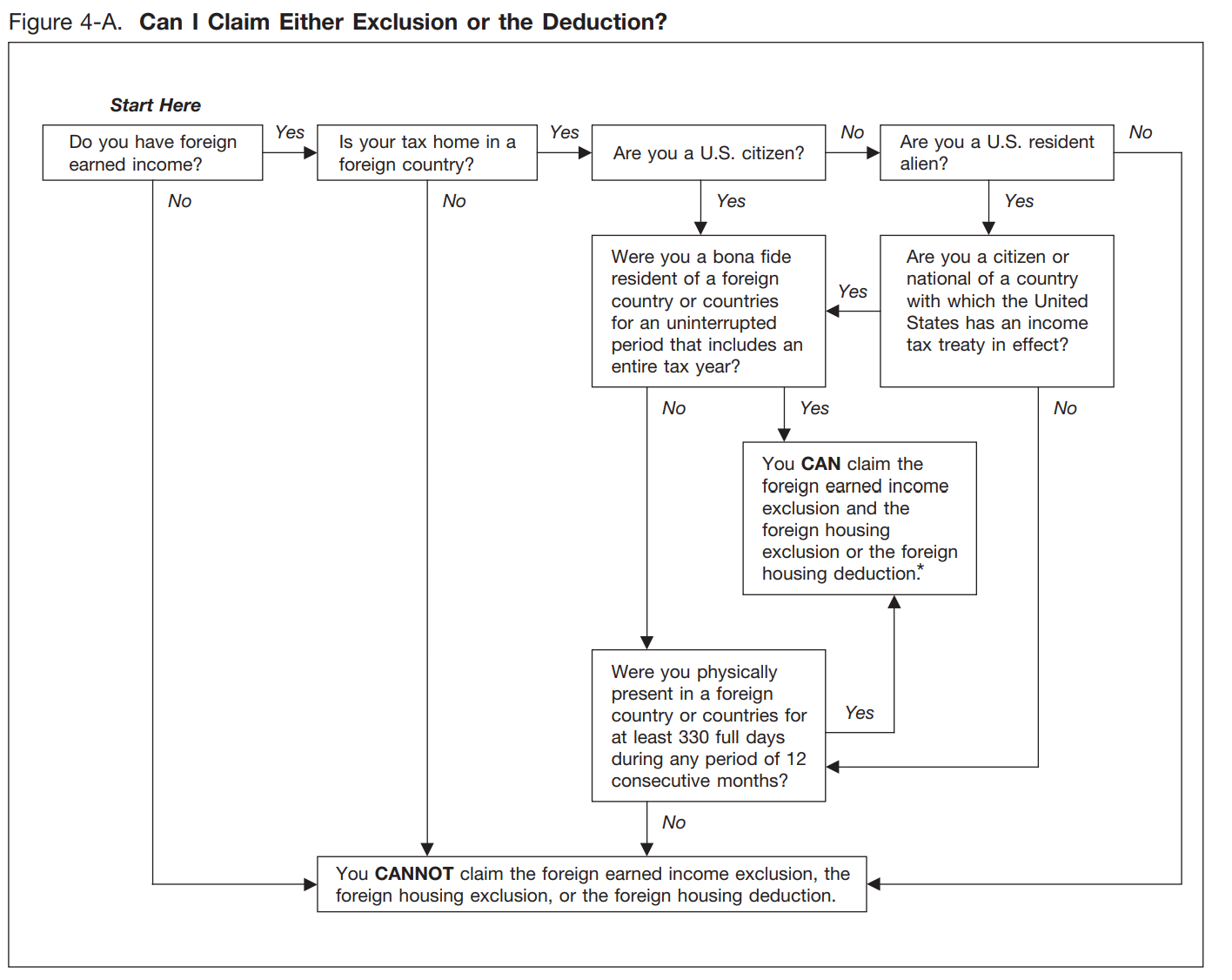

On the other hand, passive revenue such as rate of interest, returns, and capital gains do not certify for exclusion under the FEIE. Particular eligibility tests require to be fulfilled in order for migrants to certify for the FEIE arrangement. There are two key tests to determine eligibility for the FEIE: the Physical Visibility Test and the Authentic Residence Test.

What Does Feie Calculator Do?

The United state taxpayer should have foreign-earned income. This United state taxpayer need to have a tax home in a foreign nation (with a tax obligation home defined as the place where a person is engaged in work).

It's suggested that individuals use travel trackers or apps that enable them to log their days invested in various locations, making sure that they satisfy the 330-day need. The United state taxpayer need to have a tax home in a foreign country.

taxpayer has to have been an authentic homeowner of an international country for a minimum of one tax year. "Authentic citizen" standing needs demonstrating long-term international living with no brewing return to the U.S. Key indicators of this standing might include long-term housing (whether leased or owned), neighborhood bank accounts, or obtaining a residency visa.

The 10-Minute Rule for Feie Calculator

For couples, both partners will certainly require to complete a separate Kind 2555, even if they're submitting tax obligations jointly. To finish a 2555 form, you'll require to: Select between the Bona Fide Residence Examination and the Physical Existence Test Record all global traveling to and from the United States throughout the tax obligation year.

Mark computes the exchange price (e.g., 1 EUR = 1.10 USD) and transforms his wage (54,000 1.10 = $59,400). Considering that he resided in Germany all year, the percent of time he stayed abroad during the tax is 100% and he gets in $59,400 as his FEIE. Mark reports complete wages on his Form 1040 and gets in the FEIE as an unfavorable amount on Arrange 1, Line 8d, lowering his taxable earnings.

The Main Principles Of Feie Calculator

Choosing the FEIE when it's not the very best option: The FEIE might not be optimal if you have a high unearned earnings, earn more than the exemption limitation, or live in a high-tax nation where the Foreign Tax Credit Score (FTC) might be more advantageous (Foreign Earned Income Exclusion). The Foreign Tax Obligation Credit Rating (FTC) is a tax obligation decrease strategy usually made use of along with the FEIE

deportees to counter their U.S. tax obligation debt with international earnings tax obligations paid on a dollar-for-dollar decrease basis. This implies that in high-tax nations, the FTC can often remove U.S. tax financial obligation completely. The FTC has restrictions on qualified taxes and the maximum insurance claim amount: Qualified tax obligations: Only income taxes (or tax obligations in lieu of revenue tax obligations) paid to foreign governments are eligible.

tax obligation obligation on your foreign earnings. If the foreign tax obligations you paid surpass this limit, the excess international tax can typically be brought forward for up to reference ten years or returned one year (by means of a changed return). Maintaining accurate records of foreign income and taxes paid is for that reason crucial to calculating the appropriate FTC and keeping tax compliance.

Feie Calculator - An Overview

expatriates to reduce their tax obligation responsibilities. If a United state taxpayer has $250,000 in foreign-earned income, they can omit up to $130,000 utilizing the FEIE (2025 ). The staying $120,000 may then go through tax, however the U.S. taxpayer can possibly use the Foreign Tax obligation Credit report to counter the taxes paid to the foreign nation.

If he 'd often taken a trip, he would rather finish Component III, listing the 12-month duration he satisfied the Physical Existence Test and his travel history. Step 3: Reporting Foreign Income (Component IV): Mark made 4,500 each month (54,000 yearly). He enters this under "Foreign Earned Income." If his employer-provided housing, its value is likewise included.

The Single Strategy To Use For Feie Calculator

Choosing the FEIE when it's not the very best option: The FEIE might not be excellent if you have a high unearned income, gain greater than the exclusion limit, or reside in a high-tax nation where the Foreign Tax Obligation Debt (FTC) may be much more beneficial. The Foreign Tax Obligation Debt (FTC) is a tax obligation decrease approach usually made use of in conjunction with the FEIE.

expats to counter their U.S. tax obligation debt with international income taxes paid on a dollar-for-dollar decrease basis. This suggests that in high-tax nations, the FTC can often eliminate united state tax obligation financial obligation entirely. However, the FTC has restrictions on eligible taxes and the maximum claim quantity: Eligible tax obligations: Only earnings taxes (or tax obligations in lieu of earnings taxes) paid to foreign federal governments are qualified.

tax obligation on your foreign revenue - https://lizard-mechanic-776.notion.site/Foreign-Earned-Income-Exclusion-How-Digital-Nomads-and-American-Expats-Can-Ditch-the-Tax-Burden-240d0ece9741801892a2f0b3d5101c89?source=copy_link. If the foreign taxes you paid surpass this limit, the excess foreign tax can typically be carried onward for up to 10 years or returned one year (using an amended return). Maintaining accurate documents of international revenue and taxes paid is therefore crucial to computing the right FTC and preserving tax conformity

expatriates to minimize their tax responsibilities. For example, if a united state taxpayer has $250,000 in foreign-earned income, they can exclude up to $130,000 making use of the FEIE (2025 ). The staying $120,000 might then undergo taxes, yet the U.S. taxpayer can possibly use the Foreign Tax obligation Credit history to balance out the taxes paid to the foreign country.

Comments on “The Main Principles Of Feie Calculator”